Creator Royalties in the NFT Space

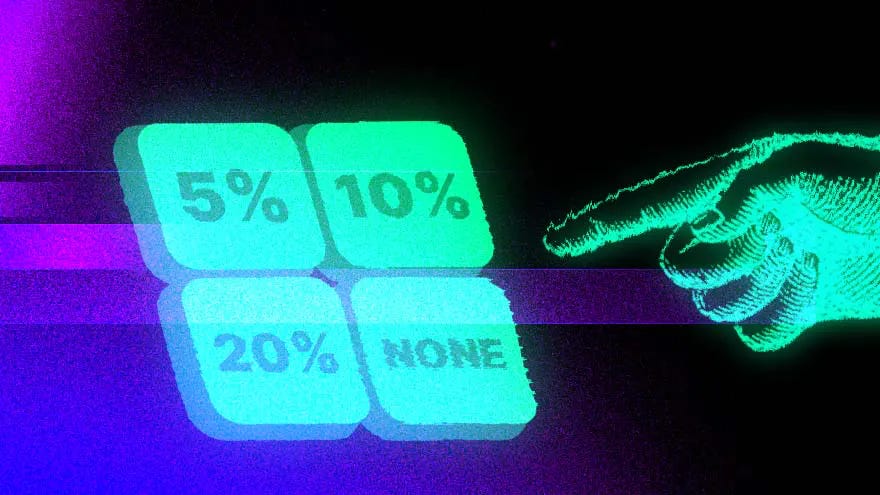

The redistribution mechanism for creators.

This article serves as an outlook & personal observation on the current state of creator royalties within the NFT market. Bringing trends, shortcomings and expectations.

NFTs are a transformative chess piece for remedying the existing inequalities within the creator economy.

Within this written offering, I look to unravel the value within creator royalties, explore ongoing market sentiment surrounding the topic and present a personal stance on the debate.

There has been a changing sentiment over creator royalties within the NFT market. Through the ongoing market developments, we can observe the gradual erosion of creator royalties, with a cost leadership war between NFT marketplaces.

Vanishing creator royalties paired with the prolonged bear market serve as a direct representation of the critical errors and arguable signs of complacency the NFT market is currently experiencing.

This debate presents an existential threat to creators within the industry and questions the status quo of the incumbent NFT marketplaces, with existing industry players gradually opting into an optional royalty policy.

To uncover the conversation further, it is essential to dive deeper into both sides of the discussion.

What is the inherent benefit of royalties within the NFT ecosystem?

Creator royalties play a significant role in the economics of NFTs.

Posing as a risk-sharing mechanism, enhancing trading via splitting the risk associated with future price volatility, is particularly applicable for low-risk sensitivity incumbents within the market. Aligning incentives long-term, as higher acting as a direct incentive for higher pricing in the future.

Creator royalties allow price discrimination, as royalties are a tool to capture value from heterogeneous buyers.

Due to the inevitable information asymmetry, dynamic pricing is present, as further value is extracted from better-informed participants long-term.

Creator royalties ensure project longevity and incentivise innovation, with the secondary sales revenue serving as the capital for unique value creation for holders post-mint.

Royalties act as a redistribution mechanism of equity for the artist's work, empowering creatives and transforming the norm for pricing. Free mint has been a prevalent phenomenon within the market, a key example of projects relying on royalties for development funding capital.

This allows creators to continue to benefit financially from their work post the initial sale and incentivises them to continue the production of new and innovative content.

What is the inherent drawback of royalties within the NFT ecosystem?

The NFT ecosystem's reliance on creator royalties as a means of compensating creators for their work presents several inherent drawbacks that have sparked a debate about alternative solutions.

As the market matures and new infrastructure is developed, the need for royalties as a means of compensation becomes less essential.

One such solution gaining traction is Blur, which utilises a community-driven approach to compensation, bypassing the need for creator royalties.

This method is gaining traction as it addresses issues such as a lack of transparency in the distribution of royalties, the potential for founders to manipulate the market through the generation of 'FUD', and a lack of transparency as a primary speculation tactic.

Lowering commissions through creator royalties allows for an opportunity for creators to charge a higher rate during the mint up front, leading to higher liquidity for the projects and therefore more commissions over the long run ,giving more capital to innovate and develop products for the community. Simultaneously lowering the hurdle rate during purchase.

Assessing the situation from the standpoint of a trader, the high gas fees associated with the purchase and sale of NFTs can act as a significant burden, and the added cost of creator royalties only exacerbates the issue. In turn, this potentially discourages traders from participating in the market and makes it difficult for creators to gain fair compensation for their work long-term.

Additionally, there are examples of founders creating 'FUD' in order to artificially inflate the value of their own projects in order to collect a higher royalty rate, further undermining the integrity of the creator royalty's place within the NFT market.

Furthermore, the current system of creator royalties also affects the liquidity of NFTs, with particular NFTs remaining locked up in creator wallets, unable to be sold, simultaneously affecting the overall value of NFTs as the royalties are often subtracted from the total value of the NFT, creating a negative impact on the overall market.

These drawbacks highlight the need for more research and experimentation with alternative solutions, such as Blur, to ensure that the NFT ecosystem can sustainably support creators while maintaining a fair and transparent market for traders and investors.

Despite these concerns, many reap that the benefits of creator royalties outweigh the drawbacks.

OpenSea recently announced its decision to enforce creator royalties on all sales of NFTs listed on its platform. Creators will receive a percentage of each sale of their NFTs, regardless of the buyer or seller. In turn, this significantly impacts project founders and traders within the ecosystem. Founders achieve a stable source of revenue through the policy, with a consistent rate of royalties as their work is sold on the platform. Serving as a means of further monetising their work and as a reward allocation for creativity.

Although meaning that the value of an NFT will be affected by the percentage of royalties that must be paid to the creator, consequently decreasing the overall value of the NFT and creating potential challenges for traders.

For traders, the decision to enforce creator royalties could mean an additional cost associated with buying and selling NFTs on OpenSea. The royalties will be added on top of the already high gas fees associated with buying and selling NFTs, which may discourage some traders from participating in the market. Additionally, the royalties may also decrease the overall value of an NFT, making it more difficult for traders to make a profit on their investments. Traders have to consider the liquidity of NFTs, as particular NFTs may remain locked up in creators' wallets, unable to be sold, due to royalties.

The decision to enforce creator royalties on OpenSea is a significant development for the NFT ecosystem, potentially impacting the market potentially able to provide a stable source of revenue for creators, simultaneously creating new challenges for traders and investors in the market.

Through unique stances and platforms, opting for embedding royalties has been an ignition in the debate of royalty enforcement beyond the social layer, on the protocol layer.

Encoding royalty rules for NFT sales on the protocol layer creates efficiency and transparency. Decentralisation is a key benefit of enforcing royalties on the protocol layer, with the absence of a central authority to enforce royalty payments eliminating the risk of potential bias in the system. This provides a level playing field for all participants, as all transactions are governed by the same set of rules encoded in the protocol. The rules are visible to all participants and cannot be altered without consensus, providing a transparent and fair system for NFT sales. The rules are also recorded on an immutable ledger, further increasing trust in the system.

With many NFT sales potentially happening simultaneously, the automation of royalty calculations and distribution ensures that creators receive their proper share of revenue, without the need for manual intervention. Increasing efficiency and reducing the overhead costs associated with manual calculation and distribution.

Royalties are necessary to support the long-term growth and development of the NFT market and are crucial pieces for ensuring fair creator compensation for their work. NFTs have the potential to revolutionise the creator economy by empowering artists and redistributing equity through royalties. With many increasing in regard to the impact of royalties on the secondary market, the benefits of royalties far outweigh the drawbacks. It is crucial for the industry to continue to explore ways to support the growth and development of the NFT market simultaneously not neglecting founders, and ensuring fair work compensation.

Looking forward to further discussions on creator royalties.