TON

The crypto offspring of Telegram

TON has seen rapid growth in recent months in a push to capture user mindshare and generate user engagement. Anchored by Telegram’s vast and growing user base, TON leverages the social app’s existing audience and taps into Telegram’s distribution to connect directly with users.

This case presents a fascinating case study of how crypto ecosystems can establish a seamless user experience while hiding away the complexities of crypto.

Telegram and TON have found themselves in the limelight with the recent arrest of their founder, Pavel Durov. In this piece, I delve into the history of TON, the dApps driving user engagement, its potential shortcomings as well as how it may continue to evolve.

TON's Genesis

TON, short for 'The Open Network', came about in a somewhat dramatic manner. Initially a brainchild of Telegram, similar to Facebook's Libra project, the project was formed internally at Telegram, which then stepped away from the project due to regulatory pressure. The project promised a decentralised world within the familiar interface of a globally popular messaging app. After stepping back from the project and returning investor funds, a community-led Free TON network was launched and has since been integrated into the Telegram app.

This transition marked the beginning of an ecosystem poised to leverage Telegram's massive user base, looking to foster an organic, community-driven expansion, or so it appeared.

TON's ecosystem is thriving and characterised by a unique blend of social interaction and DeFi. This symbiosis serves as the bedrock of its stably growing user base, active market presence and growing narrative.

The direct integration of TON with Telegram allows users to use the crypto network without having to leave the messaging app, creating a far more seamless user experience, altogether blurring the lines between the user's social interaction and financialization aspects that crypto brings to the equation, all while having them integrated into an already familiar user interface.

Currently, TON is experiencing immense demand on the gaming side of the platform, with deeply engaging and fun play-to-earn apps that create incentives for users and have a high level of user retention.

User Mindshare & Incentives

TON's approach to capturing user attention through unique interactions and incentives can be compared to the early days of other networks and their initial user capture through 'killer apps' such as the relationship between Base and Friend Tech.

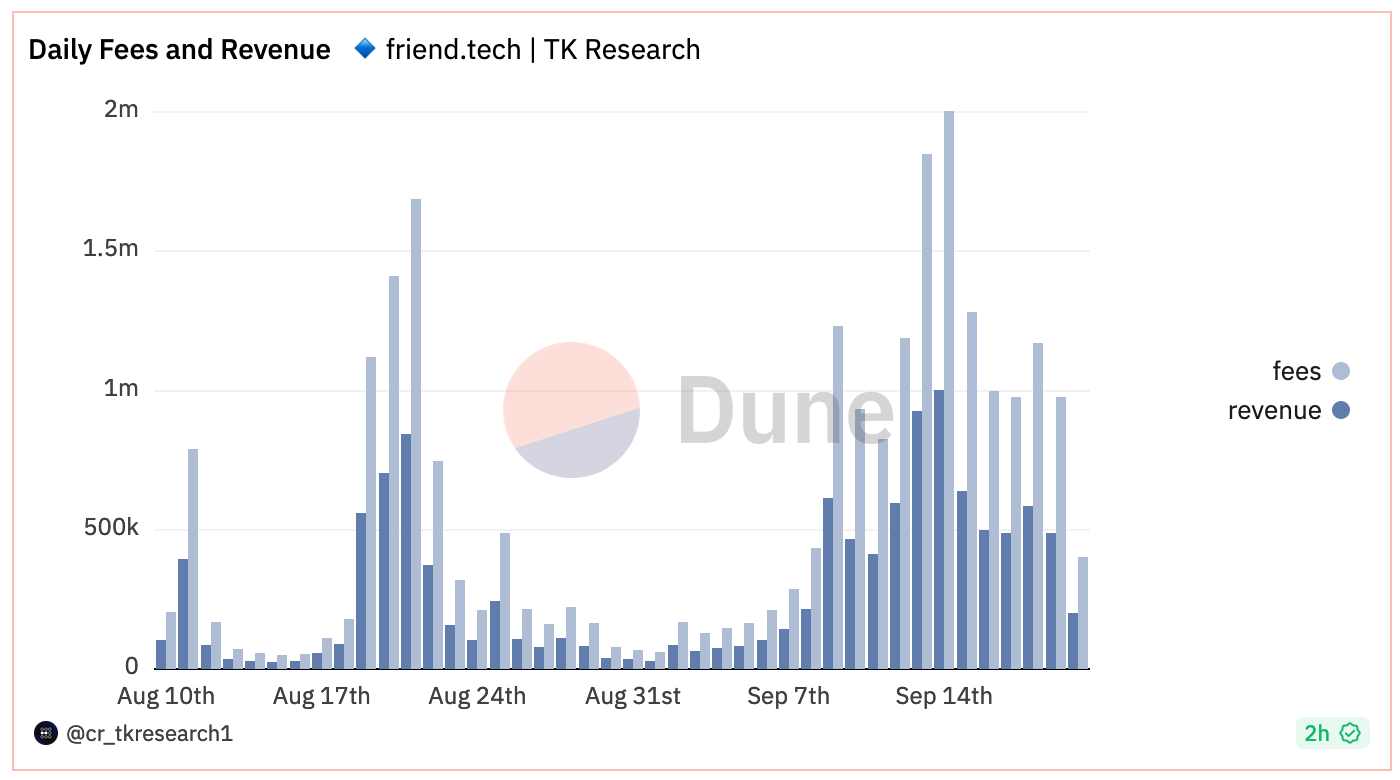

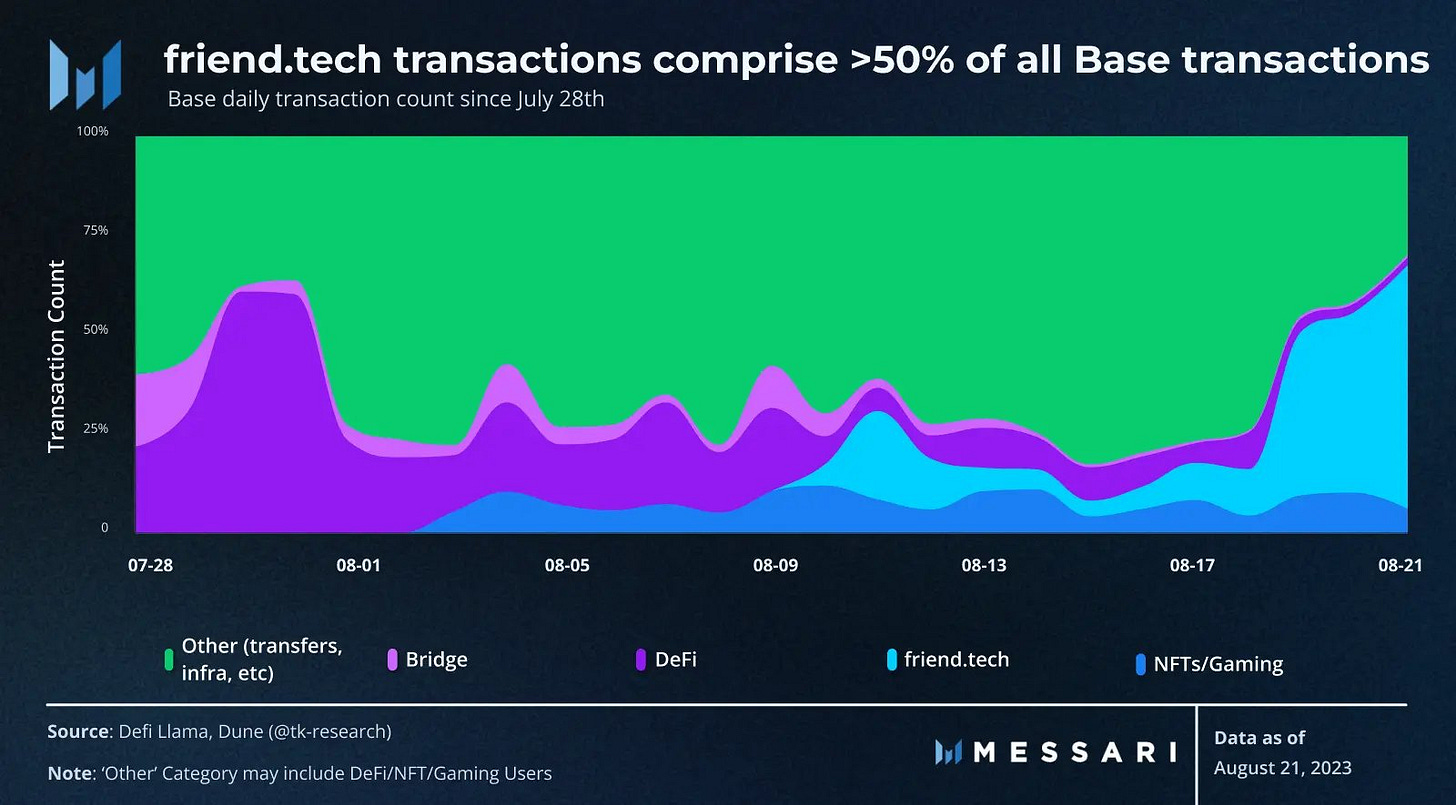

Friend Tech, a SocialFi app on Base, launched as one of the chain's cornerstone project,s showcasing the unique features Base could offer to applications with its integration with the rest of the Coinbase ecosystem. The app launch was a massive success, driving over 50% of all Base transactions being FriendTech related.

To put the success into perspective, in the first 24 hours that the platform was live, it generated more fees than Bitcoin, Uniswap, and Binance Smart Chain. As Friend Tech is on Base, the L2 was able to heavily capitalise on the success of the social app. This in turn, led to Base becoming the largest L2 ecosystem in crypto today.

Similarly, TON's ecosystem has the potential to benefit significantly from dApps that offer attractive incentives, drawing parallels to how FriendTech's offering propelled Base, despite FriendTech's subsequent decline in appeal and usage numbers.

The allure of high rewards and incentives can drive substantial user engagement and rapid growth within a platform. For instance, play-to-earn games on TON, such as HMSTR, TONCrush and TONWar, provide users with significant rewards in the form of tokens. These games have already captured user interest and driven considerable traffic to the ecosystem. Similarly, TONSwap and TONLend have previously offered lucrative DeFi opportunities, attracting users looking for high yield.

This growth strategy can create a virtuous cycle of growth, where the initial influx of users drawn by attractive incentives boosts the platform's visibility and user base. Even if the incentives prove to be unsustainable in the long run, the initial surge in activity can establish a solid foundation for the ecosystem. As seen with Base, the popularity of Friend.Tech led to a massive spike in activity, helping Base secure its position as a major L2 ecosystem despite the subsequent decline in Friend Tech's usage.

Simultaneously Friend.Tech's relationship with Base was able to show why Base is unique and allure builders to the L2 versus existing incumbents and alternative L2s with an established developer community and user mindshare.

While Friend.Tech did not end up having a success story; it positioned itself as an app attempting to innovate and test new approaches targeting consumers with a fresh take on user experience and leveraging Coinbase's distribution.

We can argue that this is what Telegram needs as of now, an app that showcases Telegram's unique nature with differentiation from other ecosystems. This cannot be achieved purely through lower-quality apps with incentives as a growth backbone.

With that said, what Telegram has achieved to this point is lower the bar of users that can get involved in farming airdrops, skipping the extra steps and allowing network participants to farm through a simple press of a button, a simplification that may catch up with them later down the line.

Building communities around value transfer

In a lot of ways, TON has been developing in a similar manner to existing companies with their go-to-market strategies in their earliest moments.

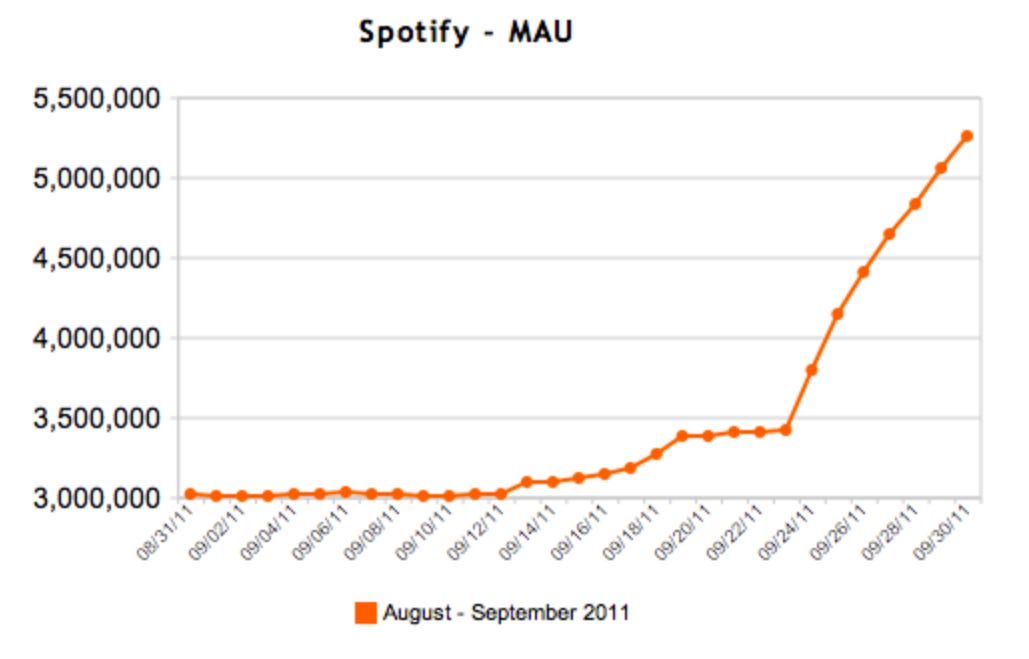

TON being embedded into Telegram brings back a reminder of Spotify's partnership and integration with Facebook in 2011, a key moment for the music streaming space. The Spotify-Facebook integration enabled users to share their listening habits and playlists directly on the page of the social media giant, serving as a significant boost to Spotify's visibility and usage.

Spotify was able to accumulate 1 million new Facebook-connected users within a 4-day period. Within six weeks, Facebook-connected Spotify users shared their listening activity over 1.5 billion times through Facebook's Open Graph, which allows developers to integrate their applications into the social media platform. Since then, the rest is history.

Similarly, TON's integration with Telegram allows developers to integrate their applications into Telegram's extensive social network, making it easier for users to discover and use the applications and services. As Spotify harnessed Facebook's social graph to build communities around music sharing, TON harnesses Telegram to build communities around value transfer.

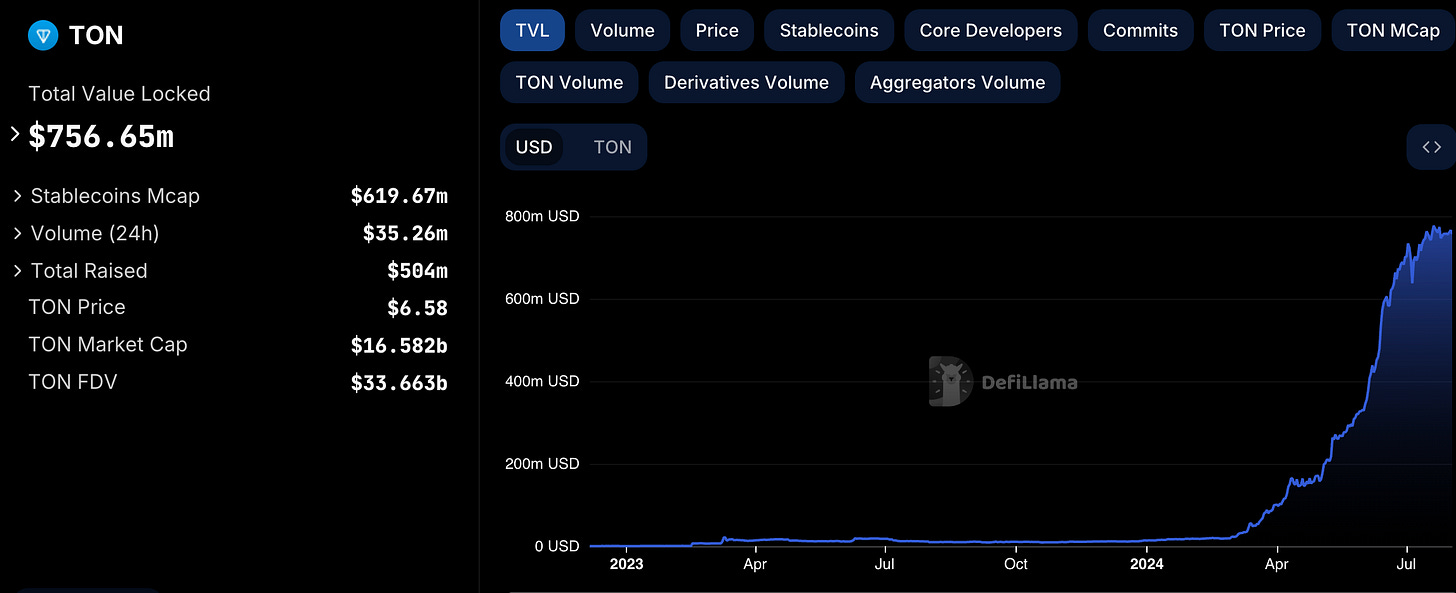

Since Telegram endorsed TON, the network has experienced consistent and progressive levels of growth, reaching over $700m in TVL at its peak.

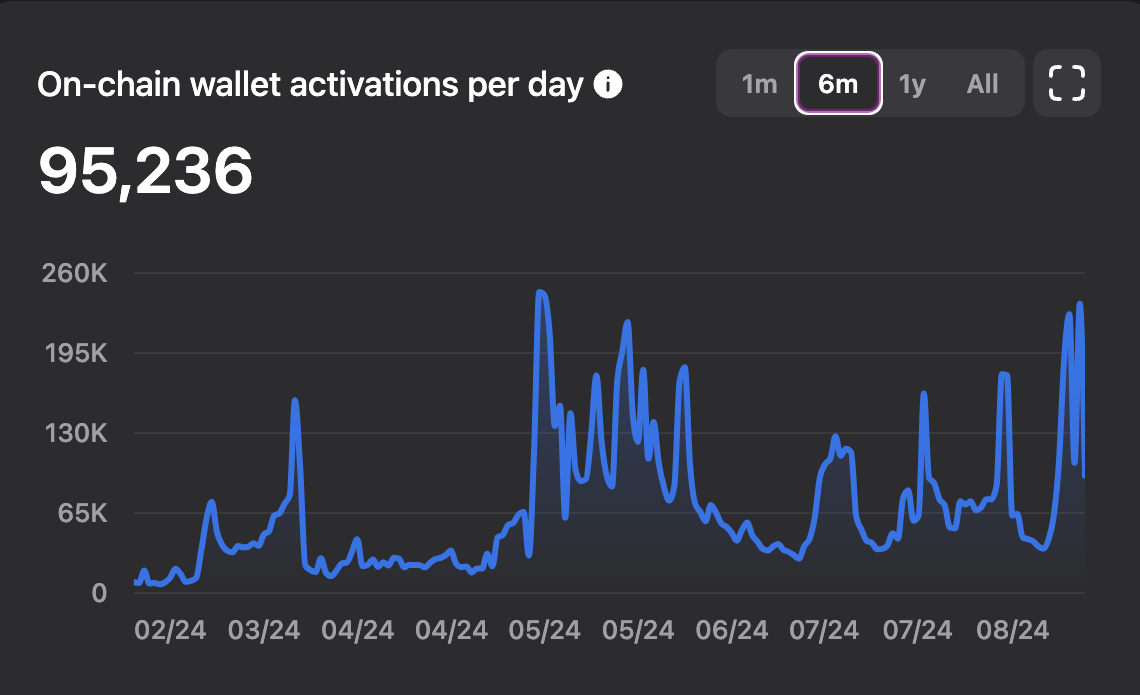

Simultaneously, the daily active wallets continue to hit all-time highs, as token holders and trading volumes show a strong uptrend.

While reasoning by analogy has its limitations, there are striking parallels between the Facebook-Spotify and Telegram-TON integrations. When Facebook integrated Spotify in 2011, Facebook had around 800 million users, and Spotify at the time had 2 million paying subscribers. Less than a year later, Spotify's paying subscribers doubled.

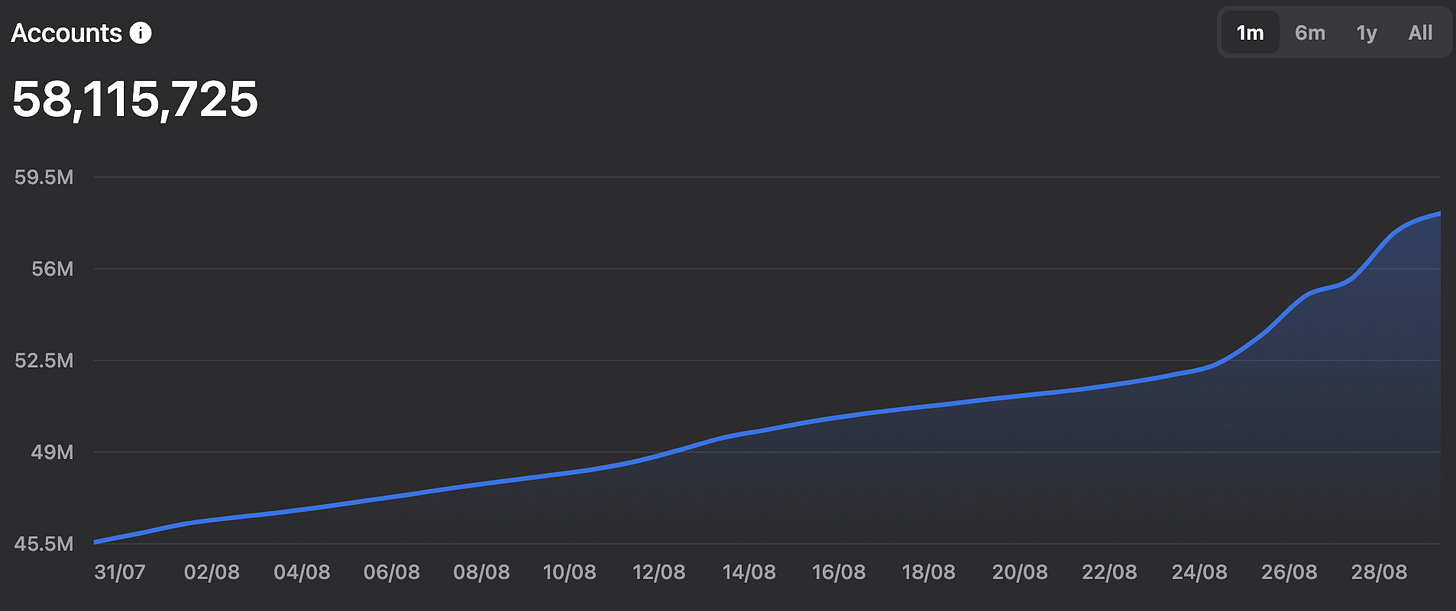

Similarly, when Telegram integrated TON in 2023, Telegram also had about 800 million users, while TON had about 100,000 monthly active wallets. Less than a year later, TON has grown to about 5.5 million monthly active wallets.

Although the increase in active users for Ton is an order of magnitude larger than Spotify's, it's important to note that comparing Spotify subscribers over a decade ago to active TON wallets now is not a direct comparison. What matters is that the adoption of a new technology saw significant growth after integrating into a massive social network.

Given that the crypto platform has only tapped into a small fraction of Telegram's user base so far, it's reasonable to expect its growth to continue as the technology continues to scale.

With this said given the currently developing case against Telegram and Pavel Durov, and deep uncertainty about the future of the platform and the network TO,N naturally saw a deep decline in key on-chain metrics and usage.

Apps on TON

Apps on TON have been interesting to follow, but a phenomenon behind a lot of the "buzz" around TON within less crypto native audiences stems from the rapid emergence of hyper casual "clicker" gaming applications, driven by Telegram's HTML5 integration. It enables the creation of user-friendly, game-like interfaces that can be easily launched within Telegram, making these games highly accessible. Clicker games typically involve simple, repetitive actions like finger tapping to earn in-game currencies, often with the expectation of a future airdrop.

Notcoin is a great study to look around this craze, serving as the first major example of a tap-to-earn game on TON, with the ability to attract over 40 million users and reach a peak of 6 million daily active users. Notcoin eventually evolved into TON's first meme coin, with its token, $NOT, launching on Binance and achieving a fully diluted valuation above $1 billion. Firmly positioning it as one of the leading gaming tokens within the TON ecosystem.

Following Notcoin's success, clicker games have dominated the top 10 applications on Telegram, with an average subscriber base of over 12 million each, showing the deep virality those apps have.

Another viral hit, Hamster Kombat, is another app worth highlighting as it was able to amass over 200 million registered users and more than 30 million daily active users, reminiscent of the early days of social gaming on platforms like Facebook. However, TON's integration with Telegram offers a modern twist, combining social engagement with financial incentives on the crypto side.

Infrastructure Challenges

Despite all the attention on the network and the vast growth it experienced, TON faces several challenges, particularly in terms of existing infrastructure and development. TON has been struck by occasional outages, with the last one having no new blocks produced in 3 hours, with a 'network overload' having TON validators become overloaded, causing them to lose consensus.

A significant limitation is the lack of Oracles such as Chainlink, which are not yet available for the ecosystem and are crucial for connecting blockchains with real-world data and enabling smart contracts to be executed based on external information. The absence of a reliable oracle infrastructure in TON means many potential apps, especially those requiring real-time data, cannot be fully realised and need to build their own substitute, which creates further bottlenecks for teams to build on TON.

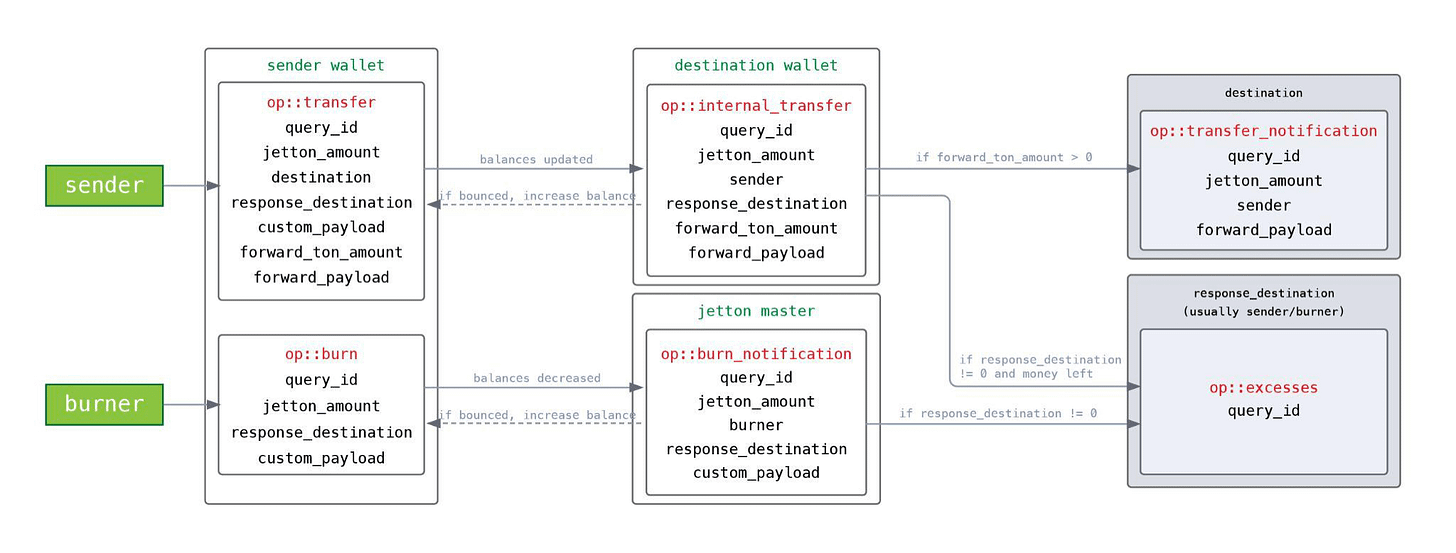

Building on TON presents immense challenges for projects. Developers often face steep learning curves due to the unique architecture and programming languages within the ecosystem. FunC is the tailor-made language for TON smart contracts.

Smart contracts are built using the Actor model on TON, with actors being technically represented as smart contracts, making the wallet a simple actor and a smart contract. Actors process incoming messages, change their internal state, and generate outbound messages as a result. That's why every smart contract on the TON Blockchain must have an address to receive messages from other actors. The absence of comprehensive developer tools and resources further complicates the process, making it difficult for new projects to launch smoothly. On TON, smart contracts are built using the Actor model. In essence, actors in TON are technically represented as smart contracts. This means that even your wallet is a simple actor [and a smart contract].

TON network demands a deep understanding of its architecture, which differs considerably from other blockchains like Ethereum. Developers must account for the intricacies of TON's asynchronous messaging and gas mechanics, which can introduce additional layers of complexity when ensuring that smart contracts are both efficient and secure. The steep learning curve, combined with the high stakes of smart contract security, poses challenges for builders and developers, particularly those new to the ecosystem, to build confidently and effectively on TON.

Rev Share & Collectables

A novel feature presented by TON is the way it unlocks new avenues for the Telegram community to monetise, share, and grow their businesses.

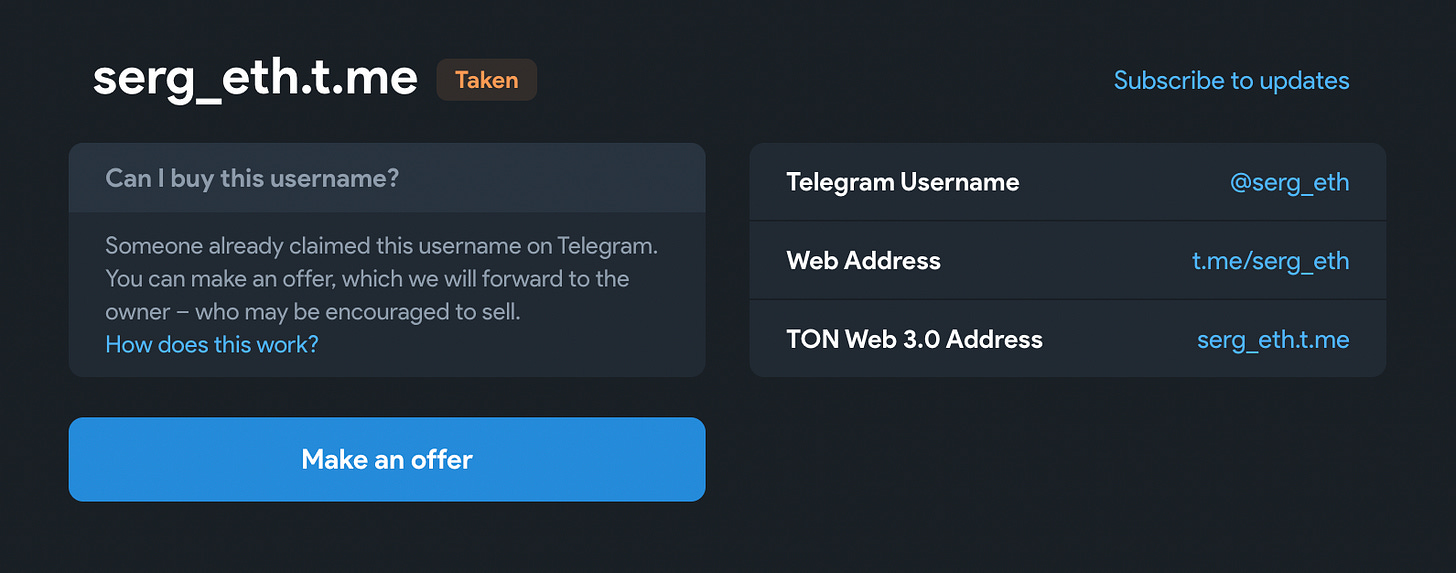

Fragment, a decentralized marketplace on the TON network, provides users with a platform to trade collectables such as virtual phone numbers and custom Telegram usernames.

To date, Fragment has facilitated over $350 million in sales of these digital assets. But this is just the beginning. In the near future, Telegram stickers - which have been sent over 730 billion times - could be transformed into NFTs, making them available for purchase and sale on the TON blockchain.

Telegram is also making a significant leap by integrating revenue sharing with content creators and channel owners through its Fragment platform, powered by the TON. This initiative marks a departure from traditional social media models, enabling creators to directly earn from ad revenues on their channels. This approach not only compensates creators for their content but also strengthens the relationship between the platform and its users, promoting a more equitable distribution of financial rewards within the ecosystem.

USDT on TON

Tether announced the deployment of its stablecoin, USDT, on TON and within Telegram's Wallet. Marking a major milestone for the space, enabling hundreds of millions of users to effortlessly send and receive stablecoins through Telegram, making transactions as simple as using Venmo or Apple Cash, is a huge unlock, especially for those making payments internationally.

The TON network's scalability ensures that transactions between users incur a fixed fee of approximately $0.10, which is 66% cheaper than other crypto payment platforms. Building in on-ramps and off-ramps, such as bank transfers and exchanges, was introduced to further simplify access and usage.

Stablecoin payments via Telegram's Wallet are especially impactful for individuals in developing countries, where access to traditional banking services is limited. Users often face challenges with complex crypto interfaces when storing and transferring funds. With stablecoins now available on the TON network, the vision of programmable peer-to-peer money and a globally accessible decentralized financial system is becoming a reality.

TON's impact on Telegram

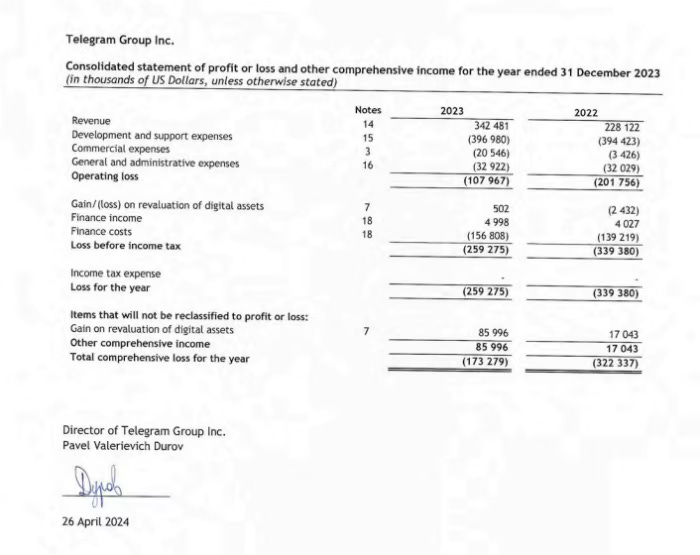

Telegram's recent PnL statement showcased Telegram's revenues from crypto and TON. The recent data threw light that Telegram currently holds $400m in crypto and has gained $148m through crypto-related activities in 2023, with the primary revenue stemming from collectable sales and integrated wallet. This goes to further highlights the reaped benefits the social network has from its crypto offspring.

What does the Future entail for TON?

Will TON be able to evangelise the crypto space to the non-crypto native communities? I find it hard to give a definitive answer at this stage, given the ongoing scrutiny both Telegram and the network face in the eyes of the regulators, the future is uncertain as there may be jurisdictional restrictions for Telegram, which will directly impact TON and its distribution, as well as existing inaccessibility of the apps native wallets to U.S. based users creating additional friction for user onboarding.

Yet, Telegram is still one of the world's fastest-growing and largest social messaging platforms, with no marketing expenditure and almost 2.5m users joining the platform a day, making it a huge channel of distribution for TON.

I am a firm believer that the narrative of onboarding the next billion users to the space will be achieved by an ecosystem or product that is able to build at the intersection of tourist and purist. TON has shown its ability to add value for both and tackle that in a creatively new manner, through its user-friendly interface and mobile-centric focus. With this said, the ecosystem is deeply nascent and deserves time to facilitate itself, attract builders, flesh out the infrastructure and tackle the ongoing hurdles and constraints it is faced with on the regulatory side.

Regards

Thank you to Nelson Ryan, Daniel Luca, Lior Messika, and Rafael Mannelid for all their help, ideas, and feedback on the piece.

Disclosure: Eden Block is not an investor in TON or any apps in its ecosystem. Yet.