Predicting Tomorrow

The Role of Free Markets in the Future of Forecasting

Once viewed as an experiment at the fringes of finance, prediction markets have moved closer to the mainstream, where platforms like Polymarket allow people to bet on real-world outcomes. From elections and sports to pop culture, prediction markets enable users to earn profits by correctly predicting the future. Beneath the speculative thrill lies a more profound question: can prediction markets sustain engagement outside peak events like elections, or are they inherently cyclical, spiking in periods of heightened media attention?

Polymarket's performance during the 2024 U.S. election was remarkable, with 20 million website views, $300 million in trading volume, and over 1 million concurrent users. The platform's open interest reached a record $463 million on Election Day, marking a 40% increase from the previous week.

Cumulatively, Polymarket has processed over $3.5 billion in trading volume related to election outcomes.

These figures underscore a significant public demand for trading in prediction markets. However, can they be relied upon, and are they sustainable?

Successes, Failures, & Lessons

Prediction markets are not a new phenomenon. The concept of financial speculation on uncertain outcomes traces back to the Iowa Electronic Markets [IEM] in the late 1980s, which allowed participants to wager on U.S. election results. By aggregating insights from traders, IEM offered forecasts that were often more accurate than traditional polls, providing a model for prediction markets as powerful information aggregation tools.

Since then, prediction markets have struggled to gain a stable foothold, facing regulatory challenges, low liquidity, and difficulty achieving significant adoption. Platforms like InTrade and PredictIt emerged as early leaders but ultimately failed. InTrade, a pioneer in geopolitical and financial predictions, became a media sensation before closing in 2013 due to regulatory pressures and liquidity challenges. Its downfall revealed a fundamental truth about prediction markets: they are vulnerable without regulatory clarity and robust liquidity.

PredictIt faced similar barriers. While it pioneered political prediction markets in the U.S., regulatory pressure from the Commodity Futures Trading Commission [CFTC] forced it to shut down in 2023. This regulatory action dampened the prediction market community, as PredictIt was a model for legally compliant, event-based trading. Polymarket, however, bypasses many of these issues by operating as a decentralised, on-chain platform, showcasing crypto’s potential to deliver transparent and open prediction markets.

Aggregating the Wisdom of the Crowd

Prediction markets operate on a simple yet profound principle: they aggregate collective intelligence by allowing participants to bet on uncertain events. Each trade is a market-based expression of probability, producing a dynamic forecast that reflects the beliefs of a wide range of participants. This approach, rooted in the “wisdom of the crowd,” capitalizes on the insight that, collectively, a diverse group’s opinions can yield accurate predictions.

In Polymarket’s setup, participants use stablecoins, typically USDC, to place bets on various outcomes. These outcomes are binary: winning bets receive a payout if the predicted event occurs; if it doesn’t, the losing bets expire worthless. Unlike traditional betting platforms, Polymarket functions as a neutral exchange, enabling users to trade with one another directly rather than with the platform. This decentralized structure allows open, peer-to-peer trading, sidestepping the legal constraints that traditional betting platforms face.

Polymarket’s architecture depends on UMA’s decentralised oracle for outcome verification. In this context, an oracle is a data source providing real-world information to smart contracts, thereby ensuring accurate, transparent results that aren’t prone to manipulation. However, reliance on third-party oracles introduces risks, highlighting a core challenge in decentralised prediction markets.

Free Markets as Information Aggregators

Prediction markets are effective because they leverage free markets' principles as efficient information aggregators. In a free market, each participant has “skin in the game,” which motivates them to invest only when they believe in their position. The resulting balance of opinions, shaped by financial incentives, yields a more reliable approximation of event probabilities than traditional methods, where biases or external agendas can influence public statements.

Prediction markets align with ‘Hayekian information theory’, where free markets are regarded as sophisticated information processors integrating knowledge dispersed across individuals. Unlike polling, which relies on stated beliefs, prediction markets incorporate financial stakes, making them less susceptible to bias. By encouraging participants to put capital behind their beliefs, prediction markets create price signals that reflect real conviction, providing a form of forecasting rooted in economic theory.

Yet, this doesn’t make prediction markets immune to flaws. As evidenced by Polymarket’s need for consistent liquidity, a well-functioning market must balance a diverse range of participants. When liquidity is limited, markets are more vulnerable to manipulation by “whales” or groups of traders capable of moving prices, compromising their role as reliable information sources.

Polymarket’s Business Model & Competitive Edge

Polymarket breaks from the traditional exchange model by avoiding transaction fees altogether, opting instead for a frictionless, accessible trading environment that aligns closely with crypto’s decentralized ethos. Rather than monetising directly from trades by taking a cut of the stakes or winnings, Polymarket relies on an indirect approach focused on strategic partnerships, potential sponsorships, and community-driven incentives. This model allows Polymarket to cultivate a loyal, engaged user base while sidestepping conventional fees, positioning itself as a platform rooted in community ownership. This strategy prioritises growth and engagement first, laying the groundwork for future monetisation through avenues like token incentives and external collaborations, creating a more inclusive and sustainable ecosystem.

Polymarket’s fully on-chain structure gives it a distinct regulatory advantage and provides its users with an unmatched level of transparency. By decentralising the marketplace, Polymarket mitigates the regulatory risk that centralised predecessors like PredictIt and InTrade faced, positioning itself as a secure and censorship-resistant alternative.

Liquidity, Market Manipulation & Regulatory Barriers

Polymarket and other prediction markets face significant challenges, especially around liquidity. Sufficient trading volume and open interest are essential to creating an efficient market and ensuring prices reflect real probabilities. With sufficient liquidity to balance opposing views, prediction markets can avoid being swayed by well-capitalised players or coordinated groups, whose trades can distort market prices and erode credibility.

In August 2024, for instance, a group of traders accounted for over 23% of Polymarket’s daily volume on bets related to the U.S. election, highlighting the risks of concentrated market power. When a few players dominate trading, prices may reflect their interests rather than the crowd's collective wisdom.

Wash trading, where users rapidly buy and sell assets to inflate trading volume, poses another risk. Nearly 41% of Polymarket’s volume stemmed from penny-share trades, inflating reported figures and undermining the credibility of metrics that could otherwise signify genuine interest.

Election Cycles & the Prediction Market Cycle

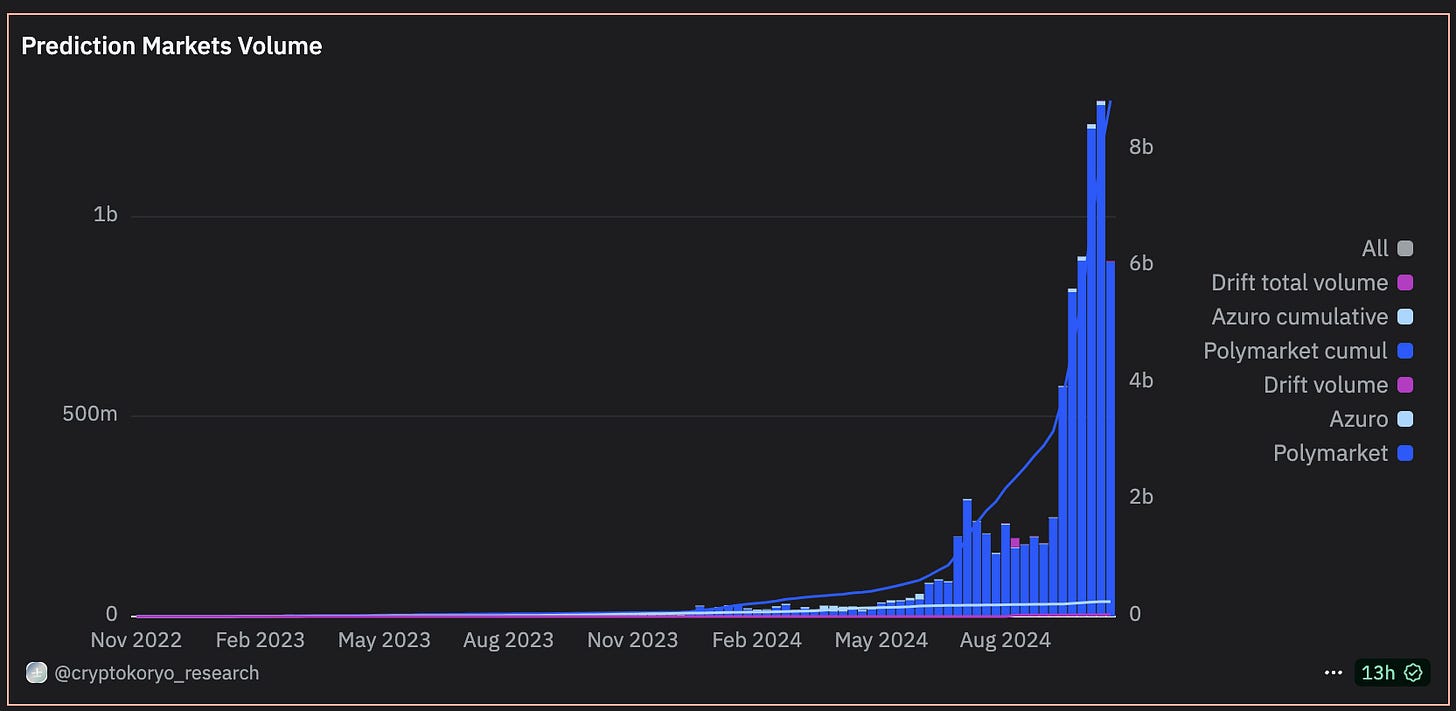

The cyclical nature of prediction market engagement is a defining question for these platforms. Historically, prediction markets see spikes in activity during elections or major geopolitical events, only to face declines afterwards. While Polymarket’s non-election volumes have shown growth, they fall short of levels seen during peak political events, suggesting prediction markets may naturally fluctuate with media cycles.

Still, data shows a gradual upward trend in non-election volumes, hinting at a potential product-market fit beyond election cycles. This growing engagement outside of traditional high-stakes events suggests that prediction markets are finding resonance with audiences interested in speculative and entertainment-driven trading. The rise of “meme markets”, where users wager on viral or humorous topics, points to a new use case for prediction markets as a form of speculative entertainment, potentially expanding their reach.

Trusting Prediction Market Outcomes

Oracles are central in prediction markets, especially in decentralized platforms like Polymarket. An oracle is a trusted data source that provides real-world event outcomes to smart contracts, allowing for automated payouts. However, oracles introduce vulnerability. Polymarket’s reliance on UMA’s decentralised oracle, for instance, means that a sufficiently influential actor could manipulate outcomes, calling into question the integrity of decentralised prediction markets.

This dependence on third-party oracles underscores the need for further innovation in oracle reliability. The resolution process must be accurate and tamper-proof in a well-functioning prediction market. The oracle problem remains one of the most pressing challenges in decentralised finance, and robust solutions are needed if prediction markets are to serve as impartial truth providers.

Philosophical Implications & Real-World Impact

Prediction markets embody a vision of free-market information synthesis, where financial stakes reveal genuine beliefs and aggregate insights. By quantifying uncertainty through price signals, prediction markets translate individual expectations into a framework for collective forecasting. In theory, these markets offer an unbiased alternative to polls, producing probabilistic insights that can inform decision-making.

Moreover, prediction markets open the door to a new category of uncertainty-driven financial products. They could enable novel risk instruments, such as event-driven insurance contracts, while offering transparent, market-based indicators of public sentiment. The philosophical implications are profound: prediction markets, as decentralised instruments, democratise information and incentivise accuracy, creating an ecosystem where speculation and truth-seeking converge.

Beyond Speculation to Sustainable Value

Prediction markets, particularly platforms like Polymarket, represent a bold approach to information synthesis, merging speculation with crowd-sourced truth. They serve as tools of insight and reflections of public psychology, attracting participants who seek to bet on everything from political events to cultural trends. Yet, as captivating as they are, prediction markets operate within a delicate balance: liquidity, manipulation risks, and regulatory pressures loom large.

For platforms like Polymarket, future success depends on several factors. First, they must expand liquidity to support diverse markets outside high-stakes cycles. If achieved, prediction markets could transition from speculative tools to stable information sources, enhancing their place within the broader financial ecosystem.

Second, the oracle problem must be addressed. A reliable, transparent, and tamper-resistant resolution mechanism is essential if prediction markets are to be trusted. Strong oracles could lend prediction markets the legitimacy needed to fulfil their promise as decentralised information aggregators.

Lastly, prediction markets must integrate with traditional financial and informational systems, positioning themselves as continuous, data-driven insights providers. With AI agents on the horizon, prediction markets may soon gain a unique form of liquidity as these automated participants place rapid, probabilistic trades in response to real-time data.

In a rapidly evolving world, prediction markets offer a tantalising vision of decentralised truth-seeking, democratising access to probabilistic insights and reflecting what society believes rather than merely speculating. If they can overcome the structural challenges, they may become a cornerstone of decentralised finance, an unbiased alternative to traditional systems, and a powerful vehicle for aggregating and quantifying collective knowledge.

For builders, traders, and observers, prediction markets provide a front-row seat to a new experiment in free-market information aggregation. The journey remains in its early stages, but the potential of prediction markets is unmistakable, a fusion of speculation, information, and philosophy that could redefine the future of finance and reshape our approach to forecasting and knowledge itself.

If you’re building in the space - please reach out, we’d love to chat.

Thank you to Nelson Ryan, Daniel Luca, Lior Messika, and Rafael Mannelid for all their help, ideas, and feedback on the piece.

Disclosure: Eden Block is not an investor in Polymarket or any prediction markets. Yet.