Infinex

Investment Thesis

Innovations in crypto infrastructure have historically outpaced those in user experience [UX]. The focus has been on scaling and solving technical challenges, leaving the UX behind as an afterthought. However, with significant progress made when it comes to scaling through the advent of L2s scaling and account abstraction, we are entering a pivotal moment where UX becomes the key battleground.

Despite the advantages of decentralised finance [DeFi] and self-custody, centralised solutions [CeFi] still dominate in terms of user adoption. This is mainly due to the superior user experience that centralised platforms can provide, especially for new crypto users. Infinex seeks to bridge this gap by creating a UX that rivals centralised exchanges while preserving DeFi's fundamental advantages.

Addressing the DeFi Market Gap

Even though decentralised finance [DeFi] offers superior features like transparency and trustless self-custody, it hasn’t been enough to draw users away from CeFi, particularly in the derivatives market, where centralised platforms continue to dominate.

Infinex aims to provide the “holy grail” of decentralised derivatives exchanges by combining a CeFi-like user experience [with security modules, account recovery, and user-friendly UI] with DeFi’s infinite advantages of transparency, self-custody, and permissionless derivatives.

Trustlessness & Transparency

Trust in decentralised systems doesn’t mean the absence of trust, but minimising it. When users control their private keys, they place trust in themselves, which can sometimes be problematic. To truly win over a broader user base, Infinex offers a third option: a system that integrates trustless technology with familiar security measures, such as social recovery with centralised, MFA-gated guardianship.

Transparency is central to trust. Unlike centralised exchanges, where users place blind trust in the platforms, self-custodial systems like Infinex offer transparency through smart contracts. These contracts not only provide clarity on how the system operates but also allow users to audit the execution of the code itself. This level of transparency is essential for building true trust in decentralized platforms.

Building for the Next Wave of Adoption

The next wave of DeFi adoption won’t happen by itself. It’s not enough to be decentralised - we must provide an experience users can trust and feel comfortable using. Infinex has built a UX layer that removes the barriers to getting on-chain while maintaining the core advantages of decentralisation.

With its Infinex Account, users can safely connect to on-chain protocols without learning anything new, setting the stage for decentralized products to finally compete with CeFi based on the value they provide.

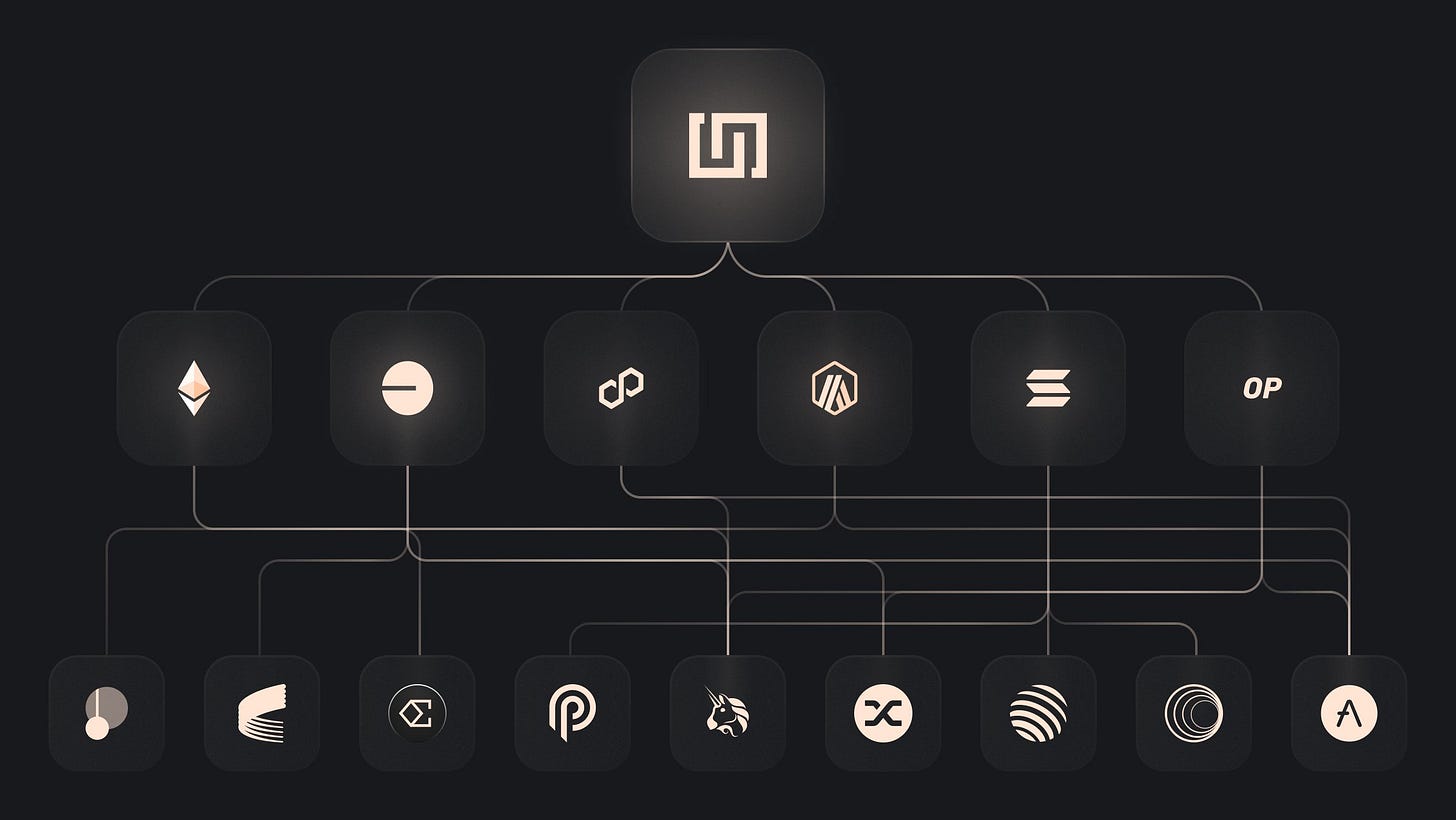

Onchain Infrastructure

The Infinex Account is implemented on EVM chains using Solidity and on Solana using Rust. While it borrows some elements from the ERC-4337 [account abstraction] standard, Infinex’s implementation is fully custom-built to optimise performance and security. The platform uses Gelato to pay for gas and relay transactions, while Triton and Helius provide RPC services for Solana transactions.

Infinex integrates with on-chain protocols through isolated smart contracts and programs that interact with the user’s Infinex Account via a limited interface. This modular approach ensures security while allowing for flexible protocol integration

Security & Passkey Architecture

Passkeys are the core security mechanism for Infinex Accounts. A passkey, which is a public-private key pair generated by the user’s operating system or password manager, is stored securely on the user’s device. The private key never leaves the user’s device and can only be unlocked via biometric or password challenges. This significantly reduces the risk of phishing or key theft compared to traditional wallets.

Since passkey signatures are not natively supported on-chain, Turnkey is used to translate passkey signatures into ECDSA [for EVM chains] or Ed25519 [for Solana] signatures, enabling on-chain transactions without compromising security.

Optimised User Experience & Censorship Resistance

Infinex’s technical design strikes a balance between user experience and security. Unlike traditional DeFi architectures, which rely heavily on thin clients and result in poor UX, Infinex assumes that the rest of its stack [frontend, backend, and RPC services] will remain online. This pragmatic approach to censorship resistance allows Infinex to provide the kind of smooth, familiar user experience that will help onboard millions of users from centralised platforms into DeFi.

Funds Recovery is a key aspect of Infinex’s security design. Users can recover their assets if they lose access to their passkeys through a variety of methods, including social sign-ons (Apple or Google accounts) or signing transactions from an external wallet. This ensures that Infinex remains accessible and secure for a wide range of users, from crypto experts to everyday traders.

Protocol Integrations

Infinex supports a wide range of protocol integrations, allowing users to seamlessly interact with various DeFi services through the Infinex Account. These integrations are approved by the Infinex Council and can be updated independently of the main Infinex Account, ensuring flexibility and scalability. The modular architecture ensures that Infinex can scale its feature set without introducing unnecessary complexity, providing a superior trading experience compared to centralised exchanges.

Addressing Common Token Distribution Issues

Unlike many projects where token distribution is skewed toward early investors and team members, often resulting in short-term sell-offs, Infinex implements a more balanced approach. The longer vesting periods for the team and investors, along with substantial community rewards, foster long-term value creation and alignment among all stakeholders. By tying rewards to the platform's performance and ensuring that the community is actively incentivised, Infinex avoids the pitfalls of traditional token distribution models.

Competitive Landscape

Infinex is uniquely positioned to compete with both centralised and decentralised incumbents, simultaneously being complementary to a lot of the products within DeFi. While centralised exchanges like Binance offer liquidity and advanced tools, they come with significant custodial risks. On the other hand, decentralised platforms like Uniswap offer non-custodial trading but often lack liquidity and advanced functionality.

Infinex bridges the gap between CeFi and DeFi. While CeFi offers familiarity, liquidity, and ease of use, it compromises on transparency and user control. Conversely, DeFi platforms offer transparency and self-custody but lack the smooth, familiar user experience. Infinex combines the best of both worlds, offering the liquidity and tools of CeFi while preserving the trustless, transparent, and decentralised properties of DeFi.

The Future of Infinex

Infinex is uniquely positioned to reshape the crypto landscape by offering a platform that doesn’t compromise on functionality, security, or decentralisation. The key to widespread adoption lies in making decentralised platforms as accessible as centralised ones. By offering a user experience equal to or better than CeFi while retaining the advantages of DeFi, Infinex is poised to lead the charge into the future of decentralised finance.

Support Infinex’s Mission

Try out the safest way to get on chain with Infinex -

https://infinex.xyz/

Docs - https://infinex.xyz/litepaper

Twitter - https://x.com/infinex_app

Discord - https://discord.gg/chainflip-community

Regards

Thank you to Nelson Ryan, Daniel Luca, Lior Messika, and Rafael Mannelid for all their help, ideas, and feedback for this Investment Thesis.

Disclosure: Eden Block is an investor in Infinex.

Nothing contained herein constitutes investment, legal, tax, or other advice nor is to be relied upon in making an investment or other decision. This presentation contains the opinions of the author, and such opinions are subject to change without notice. Furthermore, it may also include data and opinions derived from third-party sources. Eden Block does not accept liability for the accuracy or completeness of any such information or opinions which can be subject to change without notice.